FKLI Futures Trading - Bursamalaysia

This will chronicle trading in the FKLI & FCPO futures. If you don't like what you see/read in this blog, just surf away. These opinions are our personal opinions and just a record of our thoughts..."In evolution, it’s not the biggest, the fiercest nor the smartest that survive, it’s the one that changes the fastest.” I.e. the key word is to adapt the trading style to the markets, until it stops working

Thursday, April 28, 2016

Tuesday, April 26, 2016

1MDB Says It's in Default After Missing Interest Payment

2016-04-26 01:32:23.129 GMT

By Shamim Adam

(Bloomberg) -- 1Malaysia Development Bhd. said it didn't pay $50 million of interest on a $1.75 billion bond amid a dispute with Abu Dhabi's sovereign wealth fund on who should be making the payment.

The company said it's withholding an interest payment because Abu Dhabi's International Petroleum Investment Co., which is the co-guarantor of the bonds maturing in 2022, hadn't met the obligation either, according to an e-mailed statement ahead of a deadline on Monday night in New York.

"Whilst 1MDB has the funds to have made the interest payment, it is 1MDB's position, as a matter of principle, that it was IPIC's obligation to do so," the company said. "Until IPIC accepts that all obligations have been met, 1MDB is obliged to withhold payments and will seek legal recourse and resolution."

Monday, April 25, 2016

Saturday, April 23, 2016

Friday, April 22, 2016

Wednesday, April 20, 2016

To recap on our Buy call in January....

Monday, April 18, 2016

Friday, April 15, 2016

BIMB

By Asia Analytica / The Edge Financial Daily | April 14, 2016 : 10:45 AM MYT

This article first appeared in The Edge Financial Daily, on April 14, 2016.

BIMB Holdings Bhd (+ve)

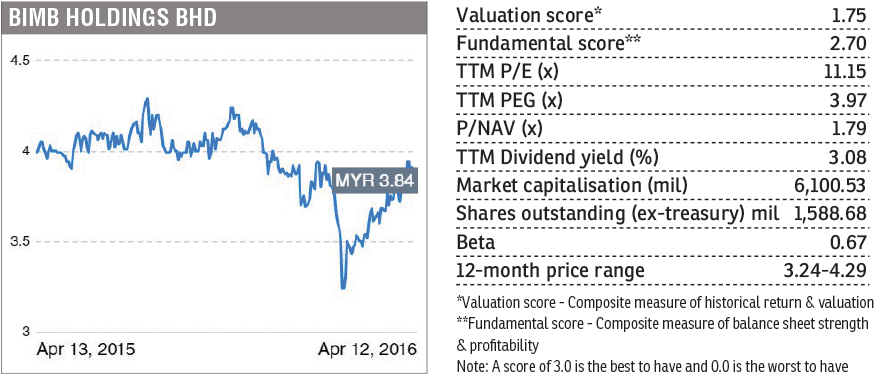

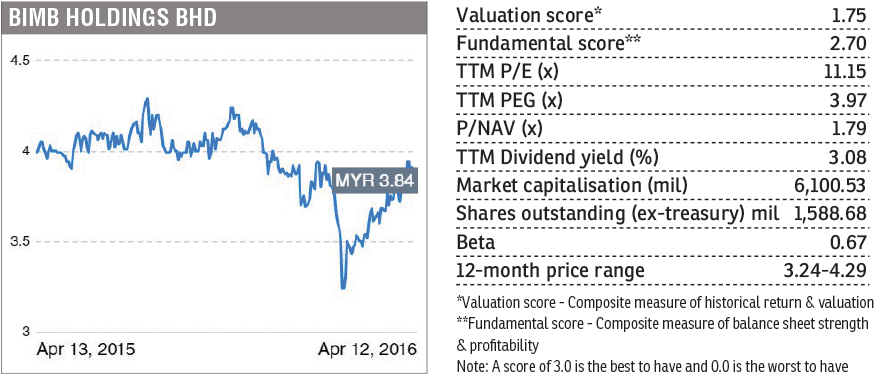

SHARES of BIMB Holdings Bhd (Fundamental: 2.7/3, Valuation: 1.75/3) triggered our momentum algorithm with 5.18 million shares being traded, as compared to its 200-days average volume of 564,690 shares. The share price rose 9 sen or 2.34% to close at RM3.93 yesterday, after reaching its intra-day high of RM4.

The syariah-compliant financial services provider for Islamic banking, takaful and stockbroking saw interest in its shares increased despite the lack of new announcement. The share price has rebounded after dropping to its one-year low at RM3.17 on Feb 3. Compared to its low on Feb 3, the share price has surged by 21.3% as of yesterday.

BIMB's fourth quarter financial year ended Dec 31, 2015 (4QFY15) saw an increase of 5.17% in net profit to RM161.9 million from RM153.9 million in the same corresponding period a year ago. The group's revenue rose 16.12% to RM884.3 million in the 4QFY15 from RM761.5 million in 4QFY14.

The better performance for the quarter was mainly due to higher income derived from investment of depositors and shareholders' fund as well as higher net income from its Takaful business.

For the full financial year 2015 (FY15), its net profit grew 2.81% to RM547.28 million from RM532.33 million in FY14 while revenue improved 11.45% to RM3.31 billion from RM2.97 billion in FY14.

On its prospect for FY16, BIMB said that Bank Islam will continuously focus on preserving capital, robust liability management and safeguarding asset quality while constantly drive earnings stability.

At its current price, BIMB is trading at a trailing P/E ratio of 11.06 times with a market capitalisation of RM6.32 billion and is 1.82 times its book value. The group also has a dividend indicated gross yield of 3.07%.

BIMB

By Asia Analytica / The Edge Financial Daily | April 14, 2016 : 10:45 AM MYT

This article first appeared in The Edge Financial Daily, on April 14, 2016.

BIMB Holdings Bhd (+ve)

SHARES of BIMB Holdings Bhd (Fundamental: 2.7/3, Valuation: 1.75/3) triggered our momentum algorithm with 5.18 million shares being traded, as compared to its 200-days average volume of 564,690 shares. The share price rose 9 sen or 2.34% to close at RM3.93 yesterday, after reaching its intra-day high of RM4.

The syariah-compliant financial services provider for Islamic banking, takaful and stockbroking saw interest in its shares increased despite the lack of new announcement. The share price has rebounded after dropping to its one-year low at RM3.17 on Feb 3. Compared to its low on Feb 3, the share price has surged by 21.3% as of yesterday.

BIMB's fourth quarter financial year ended Dec 31, 2015 (4QFY15) saw an increase of 5.17% in net profit to RM161.9 million from RM153.9 million in the same corresponding period a year ago. The group's revenue rose 16.12% to RM884.3 million in the 4QFY15 from RM761.5 million in 4QFY14.

The better performance for the quarter was mainly due to higher income derived from investment of depositors and shareholders' fund as well as higher net income from its Takaful business.

For the full financial year 2015 (FY15), its net profit grew 2.81% to RM547.28 million from RM532.33 million in FY14 while revenue improved 11.45% to RM3.31 billion from RM2.97 billion in FY14.

On its prospect for FY16, BIMB said that Bank Islam will continuously focus on preserving capital, robust liability management and safeguarding asset quality while constantly drive earnings stability.

At its current price, BIMB is trading at a trailing P/E ratio of 11.06 times with a market capitalisation of RM6.32 billion and is 1.82 times its book value. The group also has a dividend indicated gross yield of 3.07%.

Thursday, April 14, 2016

Monday, April 11, 2016

Friday, April 08, 2016

Thursday, April 07, 2016

Tuesday, April 05, 2016

"There is the plain fool who does the wrong thing at all times anywhere, but there is the Wall Street fool who thinks he must trade all the time."J Livermore

From Dragons and Bulls by Stanley Kroll

Introduction and Foreword

The Importance of an Investment Strategy

5 The Art of War, by Sun Tau (circa 506 BC) and The Art of Trading Success (circa AD 1994)

That's the way you want to bet

Long-term v Short term trading

Technicals v Fundamentals

Perception v Reality

Part 1: Winners and Losers

Part 2: Winners and Losers

Sun Tzu: The Art of War

Those who tell don't know, those who know don't tell

Why there is no such thing as a "bad market"

The Secret to Trading Success

The Experts, do they know better?

Risk control and money management

Larry Hite: The Billion Dollar fund Manager

Systems Trading:Kroll's Suggested Method

Buy the Strength Sell the Weakness

Good advice

The 'good bets' business by Larry Hite

Don't lose your shirt

Ed Sykota's secret trend trading system