BIMB

By Asia Analytica / The Edge Financial Daily | April 14, 2016 : 10:45 AM MYT

This article first appeared in The Edge Financial Daily, on April 14, 2016.

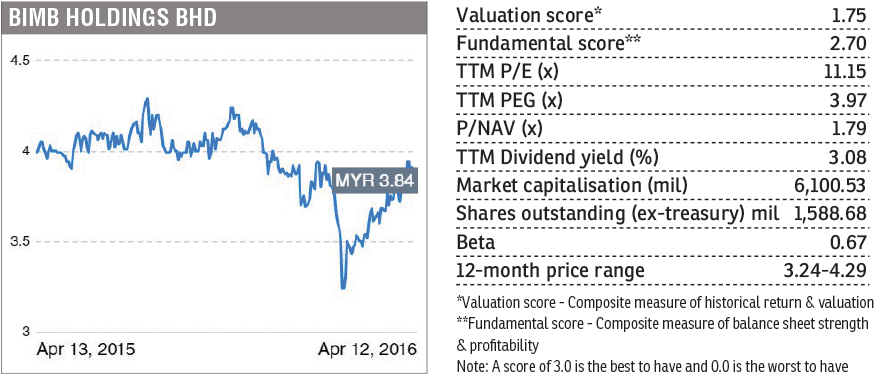

BIMB Holdings Bhd (+ve)

SHARES of BIMB Holdings Bhd (Fundamental: 2.7/3, Valuation: 1.75/3) triggered our momentum algorithm with 5.18 million shares being traded, as compared to its 200-days average volume of 564,690 shares. The share price rose 9 sen or 2.34% to close at RM3.93 yesterday, after reaching its intra-day high of RM4.

The syariah-compliant financial services provider for Islamic banking, takaful and stockbroking saw interest in its shares increased despite the lack of new announcement. The share price has rebounded after dropping to its one-year low at RM3.17 on Feb 3. Compared to its low on Feb 3, the share price has surged by 21.3% as of yesterday.

BIMB's fourth quarter financial year ended Dec 31, 2015 (4QFY15) saw an increase of 5.17% in net profit to RM161.9 million from RM153.9 million in the same corresponding period a year ago. The group's revenue rose 16.12% to RM884.3 million in the 4QFY15 from RM761.5 million in 4QFY14.

The better performance for the quarter was mainly due to higher income derived from investment of depositors and shareholders' fund as well as higher net income from its Takaful business.

For the full financial year 2015 (FY15), its net profit grew 2.81% to RM547.28 million from RM532.33 million in FY14 while revenue improved 11.45% to RM3.31 billion from RM2.97 billion in FY14.

On its prospect for FY16, BIMB said that Bank Islam will continuously focus on preserving capital, robust liability management and safeguarding asset quality while constantly drive earnings stability.

At its current price, BIMB is trading at a trailing P/E ratio of 11.06 times with a market capitalisation of RM6.32 billion and is 1.82 times its book value. The group also has a dividend indicated gross yield of 3.07%.

0 Comments:

Post a Comment

<< Home