FKLI Futures Trading - Bursamalaysia

This will chronicle trading in the FKLI & FCPO futures. If you don't like what you see/read in this blog, just surf away. These opinions are our personal opinions and just a record of our thoughts..."In evolution, it’s not the biggest, the fiercest nor the smartest that survive, it’s the one that changes the fastest.” I.e. the key word is to adapt the trading style to the markets, until it stops working

Thursday, November 30, 2006

20061130 Some participants in the market like to indulge in long term forecasting or "looking into the crystal ball". These are forecasts of target levels where they think an instrument or index might 'reach". This can be dangerous, as it will create a 'bias' in a trader/investor's minds, and thus they throw risk management out of the window.(stop loss) In truth long term trading or trend following can be a difficult task, and often requires a higher pain threshold of risk. But here goes anyway, I'll dabble in this for a bit of fun. If you look at the monthly chart of the KLCI, and project the Fib levels of the move from A to B, from C, we get an ultimate target level of around 1290. Bear in mind that it will take months to reach that level, if it ever comes at all.

20061130 Some participants in the market like to indulge in long term forecasting or "looking into the crystal ball". These are forecasts of target levels where they think an instrument or index might 'reach". This can be dangerous, as it will create a 'bias' in a trader/investor's minds, and thus they throw risk management out of the window.(stop loss) In truth long term trading or trend following can be a difficult task, and often requires a higher pain threshold of risk. But here goes anyway, I'll dabble in this for a bit of fun. If you look at the monthly chart of the KLCI, and project the Fib levels of the move from A to B, from C, we get an ultimate target level of around 1290. Bear in mind that it will take months to reach that level, if it ever comes at all.

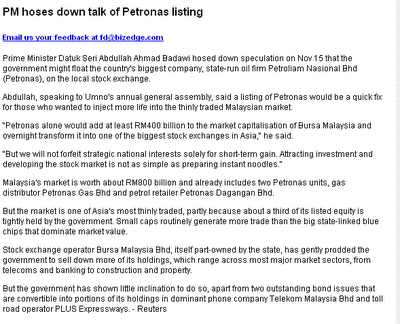

20061130 Tomorrow we will see the headlines such as "KLCI at 9 year high", "KLCI breaches 1080 due to foreign buying" blah blah blah. And aussie bank ANZ forking our RM4.30 for additional stake in AMMB, a 40% premium to last traded price. Is this irrational exuberance, or do they know something we don't. What are the signals the market is giving us? Time will tell.

20061130 Tomorrow we will see the headlines such as "KLCI at 9 year high", "KLCI breaches 1080 due to foreign buying" blah blah blah. And aussie bank ANZ forking our RM4.30 for additional stake in AMMB, a 40% premium to last traded price. Is this irrational exuberance, or do they know something we don't. What are the signals the market is giving us? Time will tell.

Wednesday, November 29, 2006

Tuesday, November 28, 2006

Monday, November 27, 2006

20061127 12:45 pm. We have the news release of the mega-plantation deal, the acquirer will pay 5% premium to last traded price in cash or shares in the new company equivalent. FKLI already looks to roll over, could be a case of 'buy the rumour, sell the fact'. Maybe we can look for shorting opportunity.

20061127 12:45 pm. We have the news release of the mega-plantation deal, the acquirer will pay 5% premium to last traded price in cash or shares in the new company equivalent. FKLI already looks to roll over, could be a case of 'buy the rumour, sell the fact'. Maybe we can look for shorting opportunity.

Saturday, November 25, 2006

20061125 Nowadays when you open up the business pages of a newspaper like thestat.com.my, it becomes apparent the direction of the fund flows that enter the market. Nowonder the index has performed spectacularly in 2006 to date. Even in Magnum's case, years of depressed share price due to insider selling, now shows the hand of the insiders, who make a General Offer to buy back the shares they sold at RM2.30. Hold on to the shares, don't sell to MPHB. Make them buy back at higher prices, because they have pummeled down the shares via insider info all these years. The ANZ AMMB stake acquisition also herald the new wave of foreign investment flowing into Bursa market. This is made possible by the openess and progressive thinking of the new leadership in the Badawi government. Dr Mahathir should be sharing in this prosperity prospect. Althugh we need Dr M as an avenue of checks and balances, through free speech. He can do much good, especially to curb the radical thinking, especially the cowboy attitude of those in UMNO youth.

20061125 Nowadays when you open up the business pages of a newspaper like thestat.com.my, it becomes apparent the direction of the fund flows that enter the market. Nowonder the index has performed spectacularly in 2006 to date. Even in Magnum's case, years of depressed share price due to insider selling, now shows the hand of the insiders, who make a General Offer to buy back the shares they sold at RM2.30. Hold on to the shares, don't sell to MPHB. Make them buy back at higher prices, because they have pummeled down the shares via insider info all these years. The ANZ AMMB stake acquisition also herald the new wave of foreign investment flowing into Bursa market. This is made possible by the openess and progressive thinking of the new leadership in the Badawi government. Dr Mahathir should be sharing in this prosperity prospect. Althugh we need Dr M as an avenue of checks and balances, through free speech. He can do much good, especially to curb the radical thinking, especially the cowboy attitude of those in UMNO youth.

Friday, November 24, 2006

Wednesday, November 22, 2006

Tuesday, November 21, 2006

Monday, November 20, 2006

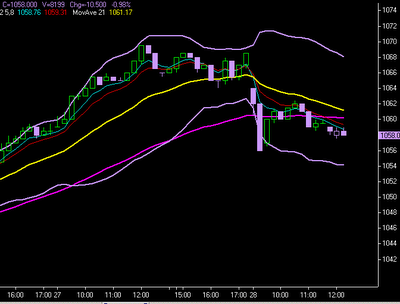

20061120 5:15 pm. If we take the opinion that the current bullish phase of the market will continue into the end of the year, then it would be best to look for an area of support to establish longer term long positions. An idea would be to look at the 200 ema on the longer term intraday timeframes.(30 min on this chart) In the shorter term, (top chart) we can see the candle bodies on the way down are larger than those on the right hand rectangular area, indicating shorter term there is more downside. This would tie up nicely into the'buy at support' scenario in the bottom chart.

20061120 5:15 pm. If we take the opinion that the current bullish phase of the market will continue into the end of the year, then it would be best to look for an area of support to establish longer term long positions. An idea would be to look at the 200 ema on the longer term intraday timeframes.(30 min on this chart) In the shorter term, (top chart) we can see the candle bodies on the way down are larger than those on the right hand rectangular area, indicating shorter term there is more downside. This would tie up nicely into the'buy at support' scenario in the bottom chart.

20061120 12:30 pm. An example of how traders/investors/analysts can get ahead of themselves in bias. This is one of a smattering of 'bullish' comments that analysts can come up with for today. In the Malaysian stock market, there is a potentially dangerous bias participants take. This a 'bullish' stance. this is because of the one directional view of trading, that is on the long side, be it stocks, warrants, convertible instruments etc. When people get too far ahead of themselves in this 'bullish' bias, the market usually turns around to drop (like this morning) or move into a larger consolidation pattern. Trading derivatives like futures on stock indices and stocks, do provide a very good advantage in the two dimensional aspect: the ability to short, along with the ability to trade long.

20061120 12:30 pm. An example of how traders/investors/analysts can get ahead of themselves in bias. This is one of a smattering of 'bullish' comments that analysts can come up with for today. In the Malaysian stock market, there is a potentially dangerous bias participants take. This a 'bullish' stance. this is because of the one directional view of trading, that is on the long side, be it stocks, warrants, convertible instruments etc. When people get too far ahead of themselves in this 'bullish' bias, the market usually turns around to drop (like this morning) or move into a larger consolidation pattern. Trading derivatives like futures on stock indices and stocks, do provide a very good advantage in the two dimensional aspect: the ability to short, along with the ability to trade long.

20061120 0857 am. This appeared in thestar.com.my this morning. So it seems the masses are waking up to the bull market. When analysts and retailers get excited, usually it signals the market would likely pause or stop the uptrend, moving into a period of consolidation and back and forth trading to digest the overbought conditions.

20061120 0857 am. This appeared in thestar.com.my this morning. So it seems the masses are waking up to the bull market. When analysts and retailers get excited, usually it signals the market would likely pause or stop the uptrend, moving into a period of consolidation and back and forth trading to digest the overbought conditions.

Saturday, November 18, 2006

20061117 5:15 pm. Looking at the daily chart of the FKLI, we can see the speed and extent of the current bull movement in price. RSI is at overbought levels, but there is yet to be any divergence forming, so this doesn't give any clue as to any end to the trend yet. Although the MACD is climbing st a steep level, which also indicates unsustainability, the MACD histogram says otherwise, pointing to continued momentum. How best to trade this? One idea would be to look for a retracement and somehow enter in the direction of the uptrend. But we will have to observe price action to confirm any biases.

20061117 5:15 pm. Looking at the daily chart of the FKLI, we can see the speed and extent of the current bull movement in price. RSI is at overbought levels, but there is yet to be any divergence forming, so this doesn't give any clue as to any end to the trend yet. Although the MACD is climbing st a steep level, which also indicates unsustainability, the MACD histogram says otherwise, pointing to continued momentum. How best to trade this? One idea would be to look for a retracement and somehow enter in the direction of the uptrend. But we will have to observe price action to confirm any biases.

Thursday, November 16, 2006

10:47 am FKLI 30 min chart shows possible triple top formation, indicting possibility of short term reversal down. Might look to set up some short trade.

Wednesday, November 15, 2006

Tuesday, November 14, 2006

Monday, November 13, 2006

20061114 5:15 pm. Price action on FKLI was a selloff into lunch sessin break, with recovery into the close of the day. This action looks to be the expected profit taking, with the recovery indicating some strength in the FKLI market to upside. So we take longs at 1015.50. The profit taking also serves some way toward alleviating the overbought conditions.

20061114 5:15 pm. Price action on FKLI was a selloff into lunch sessin break, with recovery into the close of the day. This action looks to be the expected profit taking, with the recovery indicating some strength in the FKLI market to upside. So we take longs at 1015.50. The profit taking also serves some way toward alleviating the overbought conditions.

Friday, November 10, 2006

Thursday, November 09, 2006

Wednesday, November 08, 2006

"There is the plain fool who does the wrong thing at all times anywhere, but there is the Wall Street fool who thinks he must trade all the time."J Livermore

From Dragons and Bulls by Stanley Kroll

Introduction and Foreword

The Importance of an Investment Strategy

5 The Art of War, by Sun Tau (circa 506 BC) and The Art of Trading Success (circa AD 1994)

That's the way you want to bet

Long-term v Short term trading

Technicals v Fundamentals

Perception v Reality

Part 1: Winners and Losers

Part 2: Winners and Losers

Sun Tzu: The Art of War

Those who tell don't know, those who know don't tell

Why there is no such thing as a "bad market"

The Secret to Trading Success

The Experts, do they know better?

Risk control and money management

Larry Hite: The Billion Dollar fund Manager

Systems Trading:Kroll's Suggested Method

Buy the Strength Sell the Weakness

Good advice

The 'good bets' business by Larry Hite

Don't lose your shirt

Ed Sykota's secret trend trading system