FKLI Futures Trading - Bursamalaysia

This will chronicle trading in the FKLI & FCPO futures. If you don't like what you see/read in this blog, just surf away. These opinions are our personal opinions and just a record of our thoughts..."In evolution, it’s not the biggest, the fiercest nor the smartest that survive, it’s the one that changes the fastest.” I.e. the key word is to adapt the trading style to the markets, until it stops working

Friday, March 31, 2017

Thursday, March 30, 2017

Tuesday, March 28, 2017

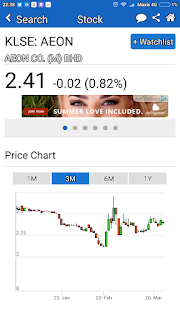

AFFIN

We bought into this stock sometime in November 2016, and a few weeks later the Ringgit started 'crashing' v the US Dollar. Entry was around 2.15-2.16.

The mass sentiment was very poor towards the stock market due to perceived currency crisis....

This is how investing works, be independent and take a view on what one expects the newspaper headlines would say SIX months later! The money is made six months ago, echoeing the words of Jesse Livermore, "The money is made in sitting, not trading"

The exchanges and brokers all project the scenario that lots of money can be made from ACTIVE trading. Fair enough, but more often than not active trading leads to ruin.

We bought into this stock sometime in November 2016, and a few weeks later the Ringgit started 'crashing' v the US Dollar. Entry was around 2.15-2.16.

The mass sentiment was very poor towards the stock market due to perceived currency crisis....

This is how investing works, be independent and take a view on what one expects the newspaper headlines would say SIX months later! The money is made six months ago, echoeing the words of Jesse Livermore, "The money is made in sitting, not trading"

The exchanges and brokers all project the scenario that lots of money can be made from ACTIVE trading. Fair enough, but more often than not active trading leads to ruin.

Monday, March 27, 2017

Saturday, March 25, 2017

Friday, March 24, 2017

Wednesday, March 22, 2017

Tuesday, March 21, 2017

Monday, March 20, 2017

Friday, March 17, 2017

Thursday, March 16, 2017

FBMKLCI

Last year around mid 2016, an experienced trader and a novice were commenting "Wh would you be in the stock market when you can meke tons of $ from futures?" Loosely translated, "We don't have the capital needed to play the stock market"

In trading/investing, we are just accountable to ourselves, nothing is right or wrong only what works. Traders who make statements such as the above are not only naive but fail to see the wood for the trees, notwithstanding the fact that they don't have much capital, despite "making tons of money..."

Last year around mid 2016, an experienced trader and a novice were commenting "Wh would you be in the stock market when you can meke tons of $ from futures?" Loosely translated, "We don't have the capital needed to play the stock market"

In trading/investing, we are just accountable to ourselves, nothing is right or wrong only what works. Traders who make statements such as the above are not only naive but fail to see the wood for the trees, notwithstanding the fact that they don't have much capital, despite "making tons of money..."

Wednesday, March 15, 2017

Tuesday, March 14, 2017

Monday, March 13, 2017

Saturday, March 11, 2017

Friday, March 10, 2017

Thursday, March 09, 2017

Wednesday, March 08, 2017

KGB Kelington Group Bhd, a small industrial gas system supplier, run by former managers of Malaysia Oxygen Bhd. We entered this stock at price of 0.36-0.37 in early February 2017. Why? There was an announcement that thise PROC billionaire (#371 on

Forbes list) Hu Keqin had bought a stake of 100 million shares out of the 270m odd shares on issue in KGB.

Current price today 0.47.

"There is the plain fool who does the wrong thing at all times anywhere, but there is the Wall Street fool who thinks he must trade all the time."J Livermore

From Dragons and Bulls by Stanley Kroll

Introduction and Foreword

The Importance of an Investment Strategy

5 The Art of War, by Sun Tau (circa 506 BC) and The Art of Trading Success (circa AD 1994)

That's the way you want to bet

Long-term v Short term trading

Technicals v Fundamentals

Perception v Reality

Part 1: Winners and Losers

Part 2: Winners and Losers

Sun Tzu: The Art of War

Those who tell don't know, those who know don't tell

Why there is no such thing as a "bad market"

The Secret to Trading Success

The Experts, do they know better?

Risk control and money management

Larry Hite: The Billion Dollar fund Manager

Systems Trading:Kroll's Suggested Method

Buy the Strength Sell the Weakness

Good advice

The 'good bets' business by Larry Hite

Don't lose your shirt

Ed Sykota's secret trend trading system